Appealing IRS Tax Determinations: When and How to Appeal IRS Collection Actions and Tax Assessments

It is essential to understand that the IRS audit and collection processes are about the IRS getting as much money as possible. In contrast, the IRS Tax Appeal process is about finding a settlement.

If you disagree with the outcome of an IRS audit or other collection process, you can appeal an IRS decision, typically if the determination letter provides appeal rights. Read on for more information about when filing an appeal should be considered.

What Are the Benefits of Appealing an IRS Decision?

Many people do not appeal against an IRS decision because they do not think they will get a favorable outcome. Surprisingly, the actual odds of getting a favorable appeal are very promising since the tax reductions made by the IRS through appeals are approximately forty percent. Some of the benefits of getting an appeal include:

- Very minimal cost to request.

- Tax liabilities can be reduced or eliminated.

The appeals process may also extend the time frame for your taxes’ due date, thus providing more time to acquire the needed funds.

What Are the Some Disadvantages of Appealing an IRS Decision?

There are a few disadvantages to initiating an appeal. One downside is the risk of an appeals officer uncovering previously missed tax liabilities, increasing the amount you owe. The other drawback is that penalties and interest on your balance continue to accrue during an appeal. If you do not win the case, you may owe more than you did before you appealed.

Employing an experienced tax attorney-CPA-EA who completely understands IRS appeals regulations and federal tax law will significantly enhance your ability to obtain a favorable outcome.

When Is It Ideal to File an Appeal With the IRS?

There are various reasons to file an IRS appeal. Although not an all-inclusive list, here are some of the common reasons for Appeal:

- Disagree with the penalty amount being assessed.

- Disagree with the IRS’s collection action, such as liens, levies, seizures, and installment agreement terminations.

- Disagree with rejection offers in compromise.

- Disagree with the findings of an IRS audit.

- Disagree with the amount of taxes the IRS claims you owe.

If you are experiencing any of these situations, raising an appeal may be an excellent option to pursue. You do not have to perform an appeal by yourself, especially since the process can be somewhat arduous and confusing. Hiring a tax attorney is an excellent way to address the matter, and if one does decide to go at it alone, one can solicit information from an IRS representative.

When Is It Not Appropriate to File an IRS Appeal?

It is not appropriate to file an IRS appeal in certain situations, such as:

- You have already signed a payment plan agreement with the IRS.

- If the issue stems from an IRS audit and you did not provide the requested information for the audit to the examiner.

- You filed an appeal after the allowable timeframe for that situation. The permissible time frame for appeals is listed within the IRS response. Typically, you are given 30 days from the date of the IRS correspondence.

- There was not an attempt made to work out the issue with the IRS revenue agent assigned to handle your case. The goal for IRS is to work it out first with the agent before an appeal is warranted.

- Your only concern is that you cannot pay the amount you owe. In this case, you could have other resolution options to consider.

- The last written correspondence from the IRS does not inform you of your right to an appeal. An example would be the correspondence you received from the IRS: a bill and no mention of appeals.

If you are unsure whether your situation allows for appeals or would be in your best interest to do so, consulting with a tax attorney may be the best way to obtain clarity for the best course of action to follow.

How Do I Appeal an IRS Collection Decision?

As mentioned, the IRS directs you to attempt to resolve the issue with the IRS office that initiated the collection action before going to the IRS Independent Office of Appeals. For example, if you want to appeal a collection decision result sent to you from an IRS unit, you must submit a written IRS Protest of the decision to that unit. If your issue is unresolved, your case will be sent to the IRS Independent Office of Appeals. As of this point, you can present your position and explain why you ascertain why the IRS has made an incorrect collection decision.

Instructions for requesting a conference with an appeals officer are provided in the letter of proposed tax adjustment. IRS uses Letter 950 – 30 Day Letter-Straight Deficiency to propose adjustments to employment taxes. It states that to request a conference with an appeals officer, the taxpayer must file either a small case request or a formal written protest with the contact person named in the letter. Whether you file a small case request or a formal written protest depends on several factors.

How Do I Make an IRS Protest?

The process begins by sending a written protest to the IRS; the address to do so will be provided on the determination letter. Typically, the protestor must be the taxpayer or the business from which the challengeable IRS determination was made. A qualified tax professional who has obtained power of attorney for that tax matter can also prepare and submit on behalf of the taxpayer.

What are the Types Of IRS Protest Available to Use?

There are two types of protest: Small Case Protest or Formal Protest. Either type will require you to provide detailed information to establish your position explaining why you disagree with the IRS determination. It is vital to draft carefully and decisively. This information will also become the basis for the IRS to establish your appeals case if you cannot resolve it at the IRS initial determination level. Ordinarily, you must send this letter to the IRS within 30 days of receiving your IRS decision notice. This date will be reflected in the notification letter.

Making a Small Case Request

A small case request is appropriate if the total tax, penalties, and interest for each tax period involved is $25,000 or less. If more than one tax period is involved and any tax period exceeds the $25,000 threshold, a formal written protest for all periods involved must be filed. The total amount includes the proposed increase or decrease in tax and penalties or claimed refund. Please note, S-Corps, Partnerships, Exempt organizations, and cases involving employee plans must always file a formal written protest, regardless of the tax debt. To make a small case request, the instructions in the letter of proposed tax adjustment provide that the taxpayer should send a brief written statement requesting an appeals conference and indicate the changes with which it does not agree and the reasons it does not agree with them.

Be sure to send the protest within the time limit specified in the letter you received, generally 30 days.

Filing a Formal Protest

When a formal protest is required, it should be sent within the time limit specified in the letter. The following should be provided in the protest:

- Your name and address and a daytime telephone number.

- A statement that you want to appeal the IRS findings to the Appeals Office.

- A copy of the letter proposed tax adjustment.

- The tax periods or years involved.

- A list of the changes you disagree with and the reason for disagreement.

- The facts supporting your position on any issue that you disagree with.

- The law or authority, if any, on which you are relying.

- You must sign the written protest, stating that it is true, under the penalties of perjury as follows: “Under the penalties of perjury, I declare that I examined the facts stated in this protest, including any accompanying documents, and, to the best of my knowledge and belief, they are true, correct, and complete.”

What IRS Appeal Types are Available, and When Should I Use Them?

Collection Due Process (CDP) Hearings

The IRS Collection Due Process (CDP) is a process that allows taxpayers to dispute IRS collection actions. CDP includes IRS determinations about tax liens, levies, and asset seizures. The IRS will send you a notice outlining your rights if you have a right to request a CDP Hearing.

You can present your case at a CDP hearing and explain why you believe the IRS’s collection action is incorrect. The IRS official will then determine your case.

You have 30 days to request a CDP hearing from receipt of the notice. Filing a timely CDP hearing request will stem any levy action until the process is completed. You can request a judicial review from the Tax Court if you disagree with the results of the CPD hearing.

If you miss the 30-day deadline, you have a year to request a CDP Equivalent Hearing. If you request within this time frame, the IRS won’t halt the levy action, and you will forgo the right to request a judicial review. You can request a CPD hearing by filing Form 12153 (Request for a Collection Due Process or Equivalent Hearing).

Collection Appeals Program

The Collection Appeals Program (CAP) can be used to appeal various types of IRS collection actions, including the following:

- Installment Agreement rejections, terminations, and modifications.

- Levies.

- Federal Tax Liens.

- Rejection of requests to return levied property.

- Asset and account seizures.

To initiate this appeal type, call the number listed on your notice or contact the IRS Revenue Officer dedicated to your case. You must also talk with an IRS collection manager and submit IRS Form 9423 – Collection Appeals Request. Before the call, ensure you have pertinent documents and details supporting your position.

How Do I Appeal a Tax Lien?

You can appeal the lien if you have received a notice of a Federal Tax Lien filed on your property. Depending upon your situation, several appeal options exist Collection Due Process or Equivalent Hearing (use IRS Form 12153) or the Collection Appeals Program.

How Do I Appeal a Tax Levy?

You can appeal an IRS levy against your property. Depending upon your situation, there are several appeals options: Collection Due Process or Equivalent Hearing (use IRS Form 12153) or the Collection Appeals Program.

Once your form is received, it will be assigned to an IRS appeals officer. You can then present your case and explain why the IRS should not issue a levy. The appeals officer will determine your case. If unsatisfied with their decision, you can usually request a review.

How to Appeal a Rejected Offer in Compromise

You can appeal the decision if your submitted Offer In Compromise has been rejected. To initiate the appeals process, you must file Form 13711 (Request for Appeal of Offer in Compromise). You have 30 days to file the form from receiving the IRS rejection notice.

How to Appeal a Trust Fund Recovery Penalty

The IRS Trust Fund Recovery Penalty (TFRP) is a penalty that can be assessed against business owners or other individuals responsible for paying payroll taxes on behalf of a business. If you’ve been assessed the TFRP, you can appeal the decision.

To appeal, you must send a written protest to the address on Letter 1153 (Proposed Trust Fund Recovery Penalty Notification) along with a copy of the letter. You must explain why you are not responsible for the TFRP or why you disagree with the amount of the TFRP.

May I Go to Tax Court If I Lose My Appeal?

If you lose your Appeal, you may be eligible to go to tax court. However, you may only file certain cases in Tax Court and at certain times.

Two of the most common Tax Court cases are appeals from increases in tax following an audit (known as a deficiency proceeding) and appeals from Collection Due Process hearings:

Deficiency proceeding. The IRS usually sends you a Notice of Deficiency (90-day letter) for additional tax assessed after the audit. That letter is often referred to as the ticket to Tax Court. You are entitled to appeal against the assessment to Tax Court and must do so within 90 days, or you lose the right (subject to some exceptions) to challenge a deficiency in Tax Court. Such appeals cannot be brought to Tax Court any time you desire, only within 90 days of mailing the Notice of Deficiency.

Collections Due Process appeal. For Collections Due Process proceedings that have first been appealed to the IRS Independent Office of Appeals, you may appeal those determinations to Tax Court after Appeals has issued a Notice of Determination. If you do not timely appeal the Notice of Determination to the Tax Court within 30 days of the Notice of Determination, you lose the right to appeal those issues at Tax Court.

Get Professional Tax Help with IRS Appeals

Remember, it could take several months for the entire IRS appeals process to be completed. Be prepared to engage in a lengthy process. In addition, the whole appeals process can be challenging and stressful to navigate alone. A knowledgeable and experienced tax attorney can help you decide which path will result in the best outcome for your situation. In any interaction with an appeals officer or tax court, presenting your records and documentation in the most organized fashion can significantly impact the ultimate resolution of the dispute. A knowledgeable tax attorney CPA understands the process of appealing an audit or taking a case to tax court and can employ the necessary strategy to obtain a favorable result.

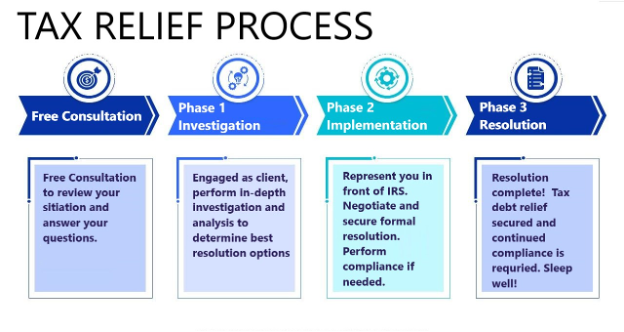

Tax Attorney-CPA-EA, Will Harmon of Harmon Tax Resolution, LLC, can help you file an appeal and negotiate with the IRS. You don’t have to deal with the IRS on your own. He can help you get relief from your tax issues. For a free consultation, call 772-418-0949 or fill out the online inquiry.

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.