What Should I Do If I Receive an IRS Notice?

Just seeing a notice from the IRS in your mailbox can often evoke a wide range of internal responses from somewhere between concern and outright panic. Even though it feels natural for these types of reactions to occur, they are not always warranted. Each year, the IRS sends millions of notices to taxpayers nationwide, so you are not alone in seeing a notice appear in your mailbox. Here are some suggested steps to follow once you have received an IRS notice, and if you are still concerned, contact a multi-licensed tax attorney-CPA-EA for further assistance with dealing with the notice.

First, relax and breathe easily. It is tough to address any situation while under the duress of panic. Please do so if you need to step back for a minute before opening the IRS notice. Panic will prevent you from thinking clearly and won’t help you resolve the situation. Once you feel calmer, proceed.

Please remember that the IRS sends notices for various reasons, from a simple notification that your account needs additional information to a request to pay back taxes. For example, during the COVID pandemic, the IRS sent notices to inform taxpayers of Economic Stimulus Payments to go out, which was helpful information. Just because you receive an IRS notice doesn’t mean a financial burden is heading your way.

So please do not disregard the notice; that will only compound the matter.

When you open the notice, please read the notice very carefully. Be sure to look for the notice’s specific instructions indicating how to satisfy the inquiry. Also, please note the time the notice allows for the response. Sometimes, not responding by the deadline prevents certain defenses and appeals from being utilized. Also, if you need help from a tax professional, providing this information as soon as possible allows for proper and timely responses.

If you find it is a correction notice, review the information contained compared to the information with your return. If you agree with the correction, there is no need to reply unless a payment is due. If you disagree, respond and explain the basis of the disagreement. In addition, be sure to include any supporting information or documents you believe are pertinent to this tax issue.

Below is a Listing of the Majority Types of IRS Notices Sent (In Numerical Order). A Brief Notice Summary Included

- CP06A – IRS Audit of Tax Return The IRS is auditing your tax return and needs documentation to verify the premium tax credit (PTC) you claimed. You are selected for audit for many reasons, such as computer screening, information comparisons, and random selection. You usually have 30 days to respond. Response form 14950 Premium Tax Credit Verification accompanies this form.

- CP080 – Credited Payments & Credits to Account The IRS credited payments and other credits to your tax account for the form and tax period shown on your notice. The IRS is reaching out because it has not received a tax return. If you have not filed a tax return and are required to, filing the return is the appropriate response. The notice will provide you with an address to file the return. If you have already filed, do not refile; call the number on the notice.

- CP11 – CHANGES TO TAX RETURN The IRS changed the return because it believes a miscalculation resulted in a tax balance owed. If the IRS position is correct, respond by remitting tax, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative form if you cannot pay. If you disagree, you must respond within 60 days of the notice. You have the option of calling the number on the notice. If you do not respond within the time frame provided, the IRS will assess the tax, and as of that point, it becomes an outstanding tax liability, which the IRS will eventually enforce collections.

- CP14 –Unpaid Taxes Owed The IRS sent this notice because you owe IRS taxes. This notice will show the taxes, penalties, interest owed, and the credits applied to the balance due. Respond by remitting full payment, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative if you cannot pay the balance in full. Read the article “How To Handle IRS CP14 Notices.”

- CP21E – IRS Made Changes to Tax Return from Audit Findings As a result of your recent audit, the IRS changed your tax return for the tax year specified on the notice. You owe money on your taxes as a result of these changes. If you agree with the changes, you can respond by remitting tax, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative if you cannot pay. If you disagree with the results:

- Request an Audit Reconsideration if you have new relevant information not disclosed to the IRS during your audit and have not paid the tax bill in full. For additional information, refer to Publication 3598, What You Should Know About the Audit Reconsideration ProcessPDF, and the article, “The Ins & Outs About IRS Audit Reconsideration.”

- If you’ve already paid the amount due in full, you must file a formal claim using Form 1040X, Amended U.S. Individual Income Tax ReturnPDF.

- If you don’t have additional information to provide but disagree with the results of your audit, you may appeal your case to the Appeals Office of the IRS. For further information, refer to Publication 5, Your Appeal Rights and How To Prepare a Protest If You Don’t AgreePDF, and the article, “Appealing IRS Tax Determinations.”

- CP22A – DATA PROCESSING ADJUSTMENTS The IRS made the changes you requested to your tax return for the tax year on the notice, resulting in a balance owed. If you disagree, contact the IRS within the time frame specified on the notice. If you agree, respond by remitting tax, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative if you cannot pay.

- CP22E – EXAMINATION ADJUSTMENT NOTICE – Due to your recent audit, the IRS changed your tax return for the tax year specified on the notice. You owe money on your taxes as a result of these changes. If you agree with the changes, you can respond by remitting tax, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative if you cannot pay. If you disagree with the results:

- Request an Audit Reconsideration if you have new relevant information not disclosed to the IRS during your audit and have not paid the tax bill in full. For additional information, refer to Publication 3598, What You Should Know About the Audit Reconsideration ProcessPDF, and the article, “The Ins & Outs About IRS Audit Reconsideration.”

- If you’ve already paid the amount due in full, you must file a formal claim using Form 1040X, Amended U.S. Individual Income Tax ReturnPDF.

- If you don’t have additional information to provide but disagree with the results of your audit, you may appeal your case to the Appeals Office of the IRS. For further information, refer to Publication 5, Your Appeal Rights and How To Prepare a Protest If You Don’t AgreePDF, and the article, “Appealing IRS Tax Determinations.”

- CP23 – IRS Changed Tax Return – Estimated Payments The IRS changed your return because it found a difference between the estimated tax payments on your tax return and the amount they posted to your account. As a result of your recent audit, the IRS made changes to your tax return for the tax year specified on the notice. You owe money on your taxes as a result of these changes. If the IRS position is correct, respond by remitting tax, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative if you cannot pay. If you disagree, you must respond within 60 days of the notice. You will have the option of calling the number on the notice. If you do not respond within the time frame provided, the IRS will assess the tax, and as of that point, it becomes an outstanding tax liability, which the IRS will eventually enforce collections.

- CP40 – ACCOUNT ASSIGNED TO PRIVATE COLLECTIONS The IRS is notifying you that it assigned your tax account to a private collection agency for collection. The collection agency will send you a letter confirming their IRS assignment. You can reach out to the private collection agency listed on the notice. You can reach out to the private collection agency listed on the notice. You still have the option to pay directly to the IRS. Private collection agencies are given limited collection authority. You can request that your case be assigned back to the IRS if you seek an Unpaid Tax Resolution Alternative. For more information, Read Publication 4518, What You Can Expect When the IRS Assigns Your Account to a Private Collection AgencyPDF.

- CP49 – Tax Refund Applied to Unpaid IRS Tax Balance The IRS used all or part of the taxpayer’s refund to pay a tax debt. This happens when you file a return, which allows for a refund; however, you have an unpaid tax balance from prior years. If you disagree, call the number on the notice. If you agree and still have a balance owed and are not already in a payment agreement with the IRS, other options may be available; see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP60 –Errant Payment Removed from Tax Account The IRS removed a payment erroneously applied to your account.

- CP71& 71C – Annual Notice of Balance Due to the IRS The IRS uses both CP 71 & C.P. 71C notices to inform you of tax interest and penalty due; with the CP71C, the IRS explains that you may lose your passport because you have a significant outstanding tax debt of at least $55,000 (threshold as of 2023). The IRS is planning to notify the U.S. State Department to have your passport revoked. To avoid you can pay the debt below the threshold amount. For ways to address unpaid tax balances, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP75 – IRS Audit of Tax Return The IRS is auditing your tax return and needs documentation to verify the Earned Income Credit (EIC) you claimed. The IRS is holding the EIC, the Additional Child Tax Credit (ACTC), and the Recovery Rebate Credit (RRC) parts of your refund until it obtains the results of this audit. If you claimed the Premium Tax Credit (PTC), the IRS may hold that portion of your refund. A separate form for each item being audited will explain the required response.

- CP75A – IRS Audit of Tax Return (EIC) The IRS is auditing your tax return and needs documentation to verify the Earned Income Credit (EIC), dependents, and filing status you claimed. You are selected for audit for many reasons, such as computer screening, information comparisons, and random selection. You will need to respond by providing the information requested. For more information about this notice, please see IRS TOPIC 654.

- CP75D – IRS Audit of Tax Return – Document Request The IRS is auditing your tax return and needs documentation to verify the income and withholding you reported. This may affect your eligibility for the Earned Income Credit (EIC), dependents, and other refundable credits you claimed. IRS is holding your refund pending the results of the audit. For more information, please refer to “Who Qualifies for the Earned Income Tax Credit (EITC).”

- CP90 – Final Notice of Intent to Levy The IRS has sent this notice to inform you that it intends to levy on certain assets. You have a right to a Collection Due Process Hearing to contest. For more information regarding IRS levies, see the articles “Important Information About IRS Tax Levies” and “Essential IRS Tax Levy Appeal Information.”

- CP75 – IRS Auditing Tax Return-EIC Verification The IRS is auditing your tax return and needs documentation to verify the Earn Income Credit (EIC) claimed on the return. IRS notifies that it is withholding EIC and, if applicable, Additional Child and Dependent Tax Credits until the results of its audit. This notice may request information to verify the Filing Status for Head of Household, Schedule C income and expense verification, and Premium Tax Credit (health insurance marketplace or exchange). Responding to the IRS will help clear up issues and have a refund issued to you. If you choose not to respond, the IRS will determine based on the information it has.

- CP80 – IRS Applies Credits – Payments to Account The IRS credited payments and/or other credits to your tax account for the tax period shown on the notice. However, they haven’t received your tax return. If you have not filed your tax return, respond by sending the return to the address listed on the notice.

- CP81 –Tax Return Not Received The IRS hasn’t received a tax return for a specific tax year. The statute of limitations to claim a refund, credit, or payment is about to expire. Need to have return filed before statute or will be eligible claim item. For more information, see “Unfiled Tax Returns and the IRS Statute of Limitation.”

- CP88 – IRS Withholding Refund The IRS is holding a refund because one or more tax returns have not been filed, and it believes the tax will be owed. Confirm returns have not been filed.

- CP90C – IRS Levy of Assets The IRS has levied you for unpaid taxes. You have a right to a Collection Due Process Hearing to contest. For more information regarding IRS levies, see the articles “Important Information About IRS Tax Levies” and “Essential IRS Tax Levy Appeal Information.” For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP91 – Final Notice Before Levy on Social Security Benefits. The IRS intends to levy your Social Security Benefits. IRS could levy up to 15% of these benefits. You have a right to a Collection Due Process Hearing to contest. For more information regarding IRS levies, see the articles “Important Information About IRS Tax Levies” and “Essential IRS Tax Levy Appeal Information.”

- CP92 – Levy The IRS Seized (levied) your state tax refund and applied it to unpaid federal taxes. You have a right to a Collection Due Process Hearing to contest. For more information regarding IRS levies, see the articles “Important Information About IRS Tax Levies” and “Essential IRS Tax Levy Appeal Information.” For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP92 – Levy The IRS Seized (levied) your state tax refund and applied it to unpaid federal taxes. You have a right to a Collection Due Process Hearing to contest. For more information on IRS levies, see the articles “Important Information About IRS Tax Levies” and “Essential IRS Tax Levy Appeal Information.” For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP161 – Notice of Unpaid Taxes Owed The IRS sent this notice because money is owed on unpaid taxes. This notice will show the taxes, penalties, interest owed, and the credits applied to the balance due. For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP162 – Failure to File 1120S or 1065 Tax Return The IRS charged the S Corporation or partnership a penalty for failure to file the 1120S or 1065 tax return. This penalty is $210 for each person who is a shareholder/partner at any time during the tax year, for each month or part of the month the return was late, for up to 12 months.

- CP210 – Tax Return Changed from Discrepancy The IRS changed the tax return that was filed because a discrepancy resulted in either an increase or decrease in the tax.

- CP220 – Tax Return Changed The IRS sent this to notify you of the change made and to advise you of the resulting balance or refund due.

- CP297C – IRS Levy The IRS has levied you for unpaid taxes. You have a right to a Collection Due Process Hearing to contest. For more information regarding IRS levies, see the articles “Important Information About IRS Tax Levies” and “Essential IRS Tax Levy Appeal Information.” For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP501 – Reminder of Balance Due (1st notice): There is a balance on the taxpayer’s account. This is the second notice the IRS sends out for past-due balances, meaning you are now in the IRS collection fold. If not addressed, the IRS may file a Notice of Federal Tax Lien on your property and property rights. Other options may be available if you cannot fully pay the tax balance. For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP503 – IRS Reminder of Tax Balance Due (2nd Notice): You have not responded to the prior CP501 notice, and there is still an unpaid balance on one of the tax accounts. If you disagree with the balance, you can appeal but must follow the notice instructions on how. IRS will start to elevate its collection efforts. Other options may be available if you cannot fully pay the tax balance. For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP504 – Notice of Intent to Levy (IRS Final Notice Before Enforcement Collection) The IRS notifies you of its intent to take further steps to levy income and seize your property and assets. However, before the IRS can facilitate any levies and seizures, it must issue a final notice of intent and right to a hearing. You will have 30 days to appeal, which can be done through a Collection Appeals Program. It’s better to prevent a levy than to have to undo one. If you cannot pay the tax, other resolution options are available. For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP508C – U.S. State Department to Be Notified This notice is sent when the IRS has identified your tax debt as meeting the “seriously delinquent” definition, resulting in the IRS providing that information to the State Department. Seriously delinquent tax debts are legally enforceable, unpaid federal tax debt (including assessed penalties and interest) totaling more than $59,000 (adjusted yearly for inflation). This could cause a revocation or denial of your passport. To rectify you can pay the tax in full or to a balance under the threshold amount. Other options are available if you cannot do either; please see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP508R The IRS has reversed the certification of your tax debt as seriously delinquent and notified the State Department of that reversal. You do not need to respond to this notice.

- CP523 – Installment Agreement Default Your IRS installment agreement is overdue, and the IRS intends to terminate your installment agreement and then initiate collection activities against you. The IRS may terminate your plan if you don’t make payment within 30 days or contact the. Then, the IRS may initiate liens, levies, garnishments, and foreclosures. Other options may be available if you cannot pay; please see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP2000 – Proposed Changes on Your Tax Return The IRS computer system matched the information reported on the taxpayer’s return with information reported by employers, banks, businesses, and others. A discrepancy was found, causing the notice to be generated and mailed to the taxpayer(s). The change may cause an increase or decrease in the tax or may not charge it at all. If you agree with the changes and owe, wait until the taxes have been assessed. You can respond by remitting tax, setting up some payment option, or even seeking an Unpaid Tax Resolution Alternative if you cannot pay. If you disagree with the results, contact the IRS by the deadline on the notice, usually 30 days from the notice date.

- CP2005 – The IRS Has Resolved the Issue. Congratulations, the information provided to the IRS resolved the issue and is closing the inquiry. You should receive a refund within 4 to 6 weeks from the notice date if a refund is due.

- CP2006 – IRS Received Information and Needs Additional Time The IRS has received the information you sent. The IRS is still researching the issue. They typically advise that it will be another 60 days to let you know what action they are taking. If you have been issued an IRS Notice of Deficiency, the 90-day time frame to petition the U.S. Tax Court is not halted.

- CP2501 – Third-Party Information Reported to IRS Does Not Match Tax Return. The IRS computer system matched the information reported on the taxpayer’s return with information reported by third parties. A discrepancy was found, causing the notice to be generated and mailed to the taxpayer(s). The charge may cause an increase or decrease in the tax or may not charge it at all. If you disagree, submit a response to the IRS. If information sent to the IRS by a third party is incorrect, reach out to a third party and request they send the correct information to the IRS. No response will result in the IRS issuing a CP2000 Notice for the proposed amount due. For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP3219A – The IRS Received Different Information Than Reported on Tax Return. This may result in an increase or decrease in your tax. The notice explains how the amount was calculated, what to do if you agree or disagree, and how you can challenge it in the U.S. Tax Court if you choose to do so, which you will have 90 days from the date of the notice. Also, during the 90 days, if you have additional information, you may submit it to IRS for consideration. For information on how to address the IRS tax debt, see “Dealing With IRS Unpaid Taxes and How to Resolve Them.”

- CP3219N – IRS Filed a Substitute For Return in Place of Missing Tax Return The IRS didn’t receive your tax return. They have calculated your tax, penalty, and interest based on wages and other income reported to them by employers, etc. In this case, the IRS has prepared a Substitute For Return (SFR)in place of your not filing a tax return. This SFR return will not reflect deductions and credits you may be entitled to, which could result in a higher balance due. Usually, the best course of action is to immediately file your tax return, which will replace the SFR filing. In addition, the CP3219N is a Notice of Deficiency (90-day letter). Once you receive your notice, you have 90 days (150 days if the notice is addressed to someone outside the country) from the date of the notice to file a petition with the Tax Court if you want to challenge the tax the IRS proposed. If you cannot pay the amount due, you may be eligible.

- Letter 1058 – LT11 Notice of Intent to Levy (Final Notice) This notice tells the taxpayer that the IRS intends to issue a levy(garnishment). This is a severe letter and needs to be responded to within 30 days; otherwise, you could be subject to having the IRS seize your property or rights to property. This could include wages, other income, bank accounts, business assets, or personal property such as a car and home. Contacting the IRS within the time frame is essential. You have the option to appeal. For more about appeals, see “Essential IRS Tax Levy Appeal Information.”

- Letter 12C – Additional Information Needed The IRS sends Letter 12C because it needs more information to process the tax return, such as the advance premium tax credit. Usually, a form is missing. Respond by submitting the information to the contact information provided to remedy this.

- Letter 4883C/5071C/6330C – Suspicious Individual Return Filed This letter is for suspicious returns where the IRS asks the taxpayer to call the number listed. This frequently occurs when the IRS has already received an individual tax return under your tax identification number. To remedy this, call the number on the form and be ready to send over a copy of a prior year’s filed tax return and supporting documents for the tax return.

- Letter 9297 – Summary of Taxpayer Contact An IRS collections Revenue Officer (RO) assigned to your account is requesting documentation from you. The letter lists items the R.O. would like to obtain to help collect a tax balance owed. You should respond by the deadline on the notice. If unable to, calling the R.O. beforehand would be ideal. If you choose not to respond, the R.O. may issue an official summons through a District Court order to prompt a response. R.O. may also seek information from 3rd parties, such as a bank. The typical goal for the R.O.’s information request is to complete a Collection Information Statement 433A, 433F, or 433B (for business). The information helps allow for the R.O. to make collection determinations.

- Notice of Federal Tax Lien A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government’s interest in all your property, including real estate, personal property, and financial assets. A federal tax lien exists after the IRS puts your balance due on the books (assesses your liability), Sends you a bill that explains how much you owe (Notice and Demand for Payment), and You Neglect or refuse to pay the debt in time fully.

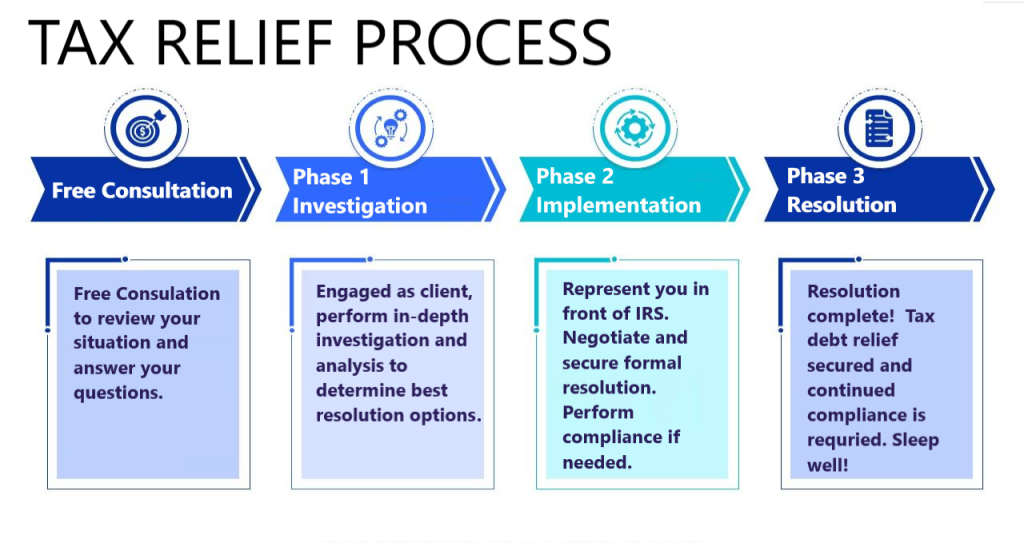

Make Sure You Have a Plan When Dealing with the IRS! Harmon Tax Resolution Comes Prepared!

We have an effective protocol for responding to each notice/letter type effectively and adequately tailored to your situation. Time is of the essence for proper response to mitigate tax debt, penalties, and interest. We are here to help. Contact us for a free consultation on how to get the relief you are entitled to. Please do not go into this issue of taxation without proper representation.

Get Trusted Legal Representation for Dealing with IRS Tax Problems

To ensure that you align yourself with the best possible tax resolution outcome, have an experienced tax professional provide expert guidance to get you there. Call today (772-418-0949) or complete an online inquiry form for a free consultation with experienced IRS Resolution Tax Attorney-CPA-EA, Will Harmon of Harmon Tax Resolution, LLC. He will handle your IRS tax issue so you can put this behind you and do what matters most.