Currently Not Collectible Status is an IRS Tax Relief Option to Help Those Struggling to Pay Both Living Expenses and Taxes

If paying both basic living expenses and IRS tax liability is causing you economic hardship, you may qualify for being granted tax relief from IRS by obtaining Currently Not Collectible Status.

What is Currently Not Collectible Status?

If the IRS places your tax account into Currently Not Collectible status, the IRS will no longer be able to enforce collection activities against you while under this status. You will not receive threatening collection notices regarding your taxes, nor will your case escalate to other enhanced collection activities such as bank levies, wage garnishments, or property foreclosures. You will be able to regroup!

How Do You Obtain IRS Currently Not Collectible Status?

To obtain IRS Currently Not Collectible status, you need to demonstrate to the IRS that you cannot simultaneously pay your tax debt and living expenses without causing severe economic hardship. You must follow an IRS criterion to prove this, and if successful, the IRS will give you a reprieve from having to pay your tax bill.

The IRS generally requires you to complete IRS Form 433-F – Collection Information Statement to establish your financial hardship position. The form requires listing your income, expenses, assets, and liabilities. Depending on your situation, the IRS may require a more in-depth listing of your financial information and direct you to complete Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals). Additional support documentation must be turned in with either form used for IRS verification purposes.

How Will the IRS Determine If I am Eligible for Currently Not Collectible (CNC) Status?

While you must demonstrate that you are unable to afford to pay both living expenses and taxes, you must also do so within specific IRS standards. The IRS has a National Standards criterion of amounts, established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous and a Local Standards housing and utilities, which is based on which locality you reside in. The IRS combines these amounts to determine the amount of allowable living expenses. If your expenses exceed the IRS allowable amounts, typically, the excess is not counted for CNC purposes.

For example, let’s say your location standard for housing and utilities is $2,050, and your actual expenditures are $2,450; the additional $400 over the allowable amount would generally not be considered by the IRS when determining your total monthly living expenses.

However, there may be exceptional circumstances, such as specific healthcare expenditures, that the IRS may consider an allowable expense over the standard amount. You will need to provide adequate documentation to substantiate your position. In situations like this, getting IRS representation from a tax lawyer-CPA who thoroughly understands the IRS allowable living expense standards and has experience advocating similar cases with the IRS may be prudent. Professional tax help could help you afford the highest allowable expense amounts or even help you qualify.

The IRS Requires Compliance When Considering Currently Non-Collectible Status Eligibility

Before the IRS places your account in CNC status, it may ask you to file any past-due tax returns.

The IRS may also review your tax withholding to ensure you have enough withheld from your employer to cover current and future taxes due. If not deemed enough, the IRS may make you change your withholding amounts accordingly to approve you for CNC.

If you have self-employment income, the IRS will want to ensure you make correct estimated payments and could even make you submit additional amounts before granting CNC approval.

What Happens While I Am in CNC Status?

While your account is in CNC status, the IRS generally won’t try to collect from you. Once the IRS places your tax debt into CNC status:

- CNC Status does not prevent the IRS from assessing interest and penalties to your account.

- The IRS may withhold and apply your tax refunds to your tax balance.

- The IRS may file a Notice of Federal Tax Lien (NFTL) when your account is placed in CNC status. Filing an NFTL can inhibit your ability to sell or borrow property or other assets.

- The IRS will not place a levy on your assets or garnish your income.

- The IRS can contact the State Department to revoke your passport if the balance is over $52,000.

- You can make voluntary tax payments on your account.

Typically, the IRS will review your financial situation annually. If your financial situation improves, the IRS may take you out of CNC status. You may be eligible for other IRS tax debt relief options if that happens. It may be prudent to have a tax attorney-CPA assist in ensuring all options are considered.

What Should I Do If the IRS Rejects My CNC Application?

If your CNC Status request is denied, you have the right to:

- Request a meeting with the IRS Collection Manager

- File an appeal:

- Collection Due Process or Equivalent Hearing.

- Collection Appeals Program – no option for tax court review.

If you are considering appealing your decision, hiring a tax attorney-CPA who could help you present the best case and ensure all of your options are considered while making the best case on your behalf would be prudent.

Does Being in CNC Status Halt the Collection Statute Expiration Date?

In addition to not having to pay a tax debt while your account is in CNC status, the Collection Statue Expiration Date (CSED) continues to toll during this period. The CSED is where the IRS has ten years to collect a tax from either the later of the tax assessment date or the filing due date. Once this date comes about, the IRS can no longer collect the tax. The tax is no longer due if your tax account is placed in the CNC status and the CSED occurs during this period.

Other tax relief options such as Installment Plans, Offer in Compromise, and Bankruptcy all have tolling periods, resulting in the CSED being extended for additional time.

If the IRS ever requests for you to sign a waiver to extend the CSED, you may want to consult with a tax professional first.

Seek Help Applying for IRS Currently Not Collectible Status

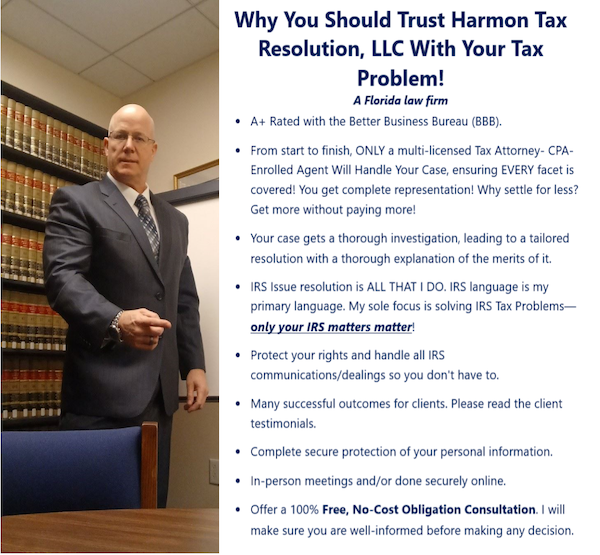

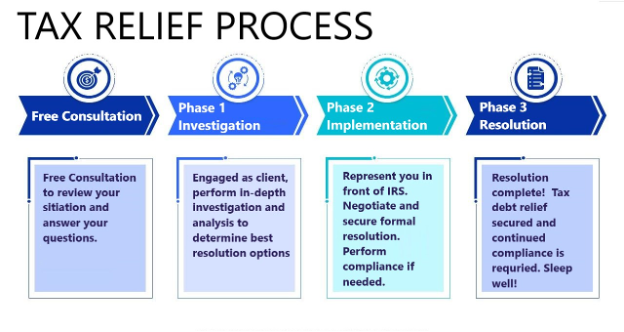

IRS collection activities could cause you financial hardship if you cannot pay the taxes owed. You may have the option to have collections halted if you are eligible to apply for IRS CNC status. To learn whether CNC or another tax relief option would work best for your relief from unpaid IRS taxes, contact tax attorney CPA EA Will Harmon Today by calling 772-418-0949 or completing the online contact form.

Tax Attorney-CPA-IRS EA Will Harmon has extensive experience helping taxpayers who, unfortunately, cannot afford to pay their IRS tax debt to negotiate optimal tax relief plans with the IRS. He can help you get the best outcome possible for your situation.

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.