IRS Offer in Compromise

This IRS Tax Resolution Plan May Afford You the Ability to Pay Off Your Tax Debt for Less Than the Balance Due

With all the current economic turmoil, some cannot afford to pay their tax debt. Unfortunately, the IRS collection arm will continue regardless; however, some IRS programs are available to these individuals to manage their tax debt.

One such program called an Offer-In-Compromise (OIC) provides an option to qualifying taxpayers with the ability to settle their tax debt for less than the balance owed.

The overall taxpayer approval rate for OICs is slightly above 30%. The IRS accepted only 15,154 offers out of 49,285 in 2021. Some of the reasons for such a low overall approval rate include the following:

- applications are not correctly completed,

- the proper application of the rules of the program is not being utilized to the taxpayer’s advantage,

- taxpayers’ positions are not adequately advocated for,

- and the IRS finds that the taxpayer can pay the total Liability.

Often, individual taxpayers attempt the application without seeking professional tax help or relying on the IRS to help them. The IRS’s goal is to collect as much tax as possible, so there will be limitations with the help of the IRS.

Will Harmon, Tax Attorney-CPA-IRS EA of Harmon Tax Resolution, LLC, can help determine whether an OIC is right for you. Use of Will’s multifaceted skillsets will ensure your case is appropriately gone over, enabling a correct eligibility determination and for him to negotiate the most favorable deal on your behalf with the IRS. If OIC is unavailable, he will find the best tax resolution option for your situation. Please read further for an overview of the OIC requirements and timeframes to assist you better.

What Is an Offer in Compromise (OIC)?

An OIC agreement between a taxpayer and the IRS settles a taxpayer’s tax liabilities for less than the full amount owed. Typically, a payoff sum is determined, and then an election is to choose a five-month or a twenty-four-month repayment plan.

A comprehensive financial analysis of your situation is completed, which the IRS uses to determine acceptance or rejection of your plan. A tax professional should assist with the financial analysis to ensure correctness. The IRS will consider the following when whether you qualify:

- Your Assets, primarily how much equity you have in them

- Your Liabilities (debts)

- Your Income

- Your Expenses (applicable national and local standards)

- Your Ability to Pay Your Taxes in Full

In some circumstances, the issue is not whether you can afford the tax liability but whether you should be liable for the tax debt. There is a type of offer for that situation as well. There are three types of OIC, which will be covered next. It’s important to thoroughly discuss the surrounding factors and circumstances to determine if a particular OIC fits your situation. Employing a tax attorney will help assess your situation correctly and ensure the best chances of approval of your OIC type.

What Are the Types of IRS Offers in Compromise, and What Are the Requirements?

The IRS provides three types of Offers In Compromise (OIC). Ideally, you should contact a tax attorney-CPA; they can let you know which compromise offers suit your situation. For a free consultation with Tax Attorney CPA EA Will Harmon, please call 772-418-0949 or submit a consultation request.

OIC – Doubt as to Collectability

Of the three plans, this is the most used. This plan provides a way to pay off your tax liability for less than the amount you owe. To qualify, you must demonstrate that you cannot pay your current living expenses and tax debt tax without experiencing severe hardship. You must complete a comprehensive financial position listing form -433A-OIC. For business income, you will use form 433B OIC. Getting tax professional help to complete this form will help ensure the IRS accepts it.

The IRS uses what they call a Reasonable Collectible Potential (RCP), which is the amount of money the IRS would be able to collect on your IRS tax bill. An RCP calculation is based on the liquidation value of your assets plus your monthly disposable income. Since the IRS uses specific standards to cap allowable expenses in the income component calculation, you must be in a low-income range to qualify.

There are two types of payment plans under this form of OIC:

- Lump Sum OIC Payment: Lump-sum offers must be paid within five payments or less. All payments must be submitted to the IRS within five months of the offer being accepted. When submitting the application, you must include 20% of your offer plus the application fee. There is no guarantee of acceptance; if rejected, the IRS will apply the payment toward the tax debt.

- Period OIC Payment: Under this plan, you have up to 24 months to pay the offer amount in full. You are not required to make a 20% down payment under this plan.

OIC-Doubt as to Liability

Doubt as to Liability exists where there is a genuine dispute as to the existence or amount of the correct tax debt under the law rather than focusing on whether you can pay based on your living expenses and tax liability. Form 656-L is used for this OIC type.

You must include a written statement explaining why the tax debt or portion of the tax debt is incorrect. For documentation, you must provide supporting documentation or evidence that will help the IRS identify the reason(s) you doubt the accuracy of the tax debt.

There are various situations in which this resolution may be ideal. Examples of IRS mistakes:

- IRS made a mistake on an IRS tax audit, resulting in an incorrect tax balance owed,

- a third party incorrectly reported the basis of an asset, resulting in additional tax owed or

- You have been incorrectly assigned a Payroll Trust Fund Penalty when you do qualify as such.

Sometimes, you may have to reconstruct your data to prove your position. Having a multi-faced tax attorney like Will Harmon, a tax Attorney-CPA-IRS EA-MBA, will ensure that all facets of your case are covered.

Since this is an offer type, an offer must be presented. Your offer amount should be based on what you believe the correct amount of the tax debt should be, not what you owe.

In many situations, there may be another way to cure the problem with the IRS. Tax law requires you to apply for another tax resolution program first. For instance, if the additional tax liability stems from an incorrect tax audit finding, you may need to apply for an Audit Reconsideration. Then, if you’re unsuccessful, you can move on to this option.

Effective Tax Administration

Effective administration is when the IRS agrees to lower your tax bill to be equitable. You don’t have to be low-income, and you don’t have to doubt that you owe the tax.

This resolution aims to produce equity and fairness in the IRS tax collection system. It is designed for situations where it would be unfair or unreasonable to enforce the tax law and make you pay your federal tax bill. It would be best if you had exceptional circumstances to qualify for this option. Most people who settle taxes this way are very advanced in age or have a severe illness. They might be able to afford to pay the tax or an offer, by doing so would cause extreme economic hardship. For example, consider someone who could sell their assets to pay taxes. However, due to a chronic illness, they may need to liquidate the assets to cover their medical expenses.

Please call to schedule a free consultation to determine if this option suits you.

Do I Qualify for an IRS Offer In Compromise?

The IRS OIC contains many eligibility requirements. Because of the complex nature of the OIC requirements, having a tax attorney CPA review your tax situation would be beneficial to see if you’re eligible.

As a rule, you must comply with all your income tax requirements for any IRS Resolution program. To be compliant, you must have filed appropriate tax returns and, if required, made all required estimated tax payments during the year. Here are some additional eligibility requirements for the IRS OIC program:

- You must have received a tax bill pertaining to at least one of the tax liabilities you’ve included in your offer.

- You are not in an active bankruptcy case.

- You must not be reasonably capable of paying your tax bill in full.

How to Apply for an Offer in Compromise Doubt To Collectability

To apply for this type of offer in compromise, you must submit the following forms to the IRS:

- Form 656 (Offer in Compromise)

- Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals)

- Form 433-B (Collection Information Statement for Businesses)

To make the Offer In Compromise, you must use Form 656. To provide information about your financial situation, use Form 433-A; for business information disclosure, use Form 433-B. In addition to thoroughly completing the applicable 433 Forms, you must provide financial documentary support.

An application fee of $205 will be included with the application. Depending on the offer type being used will determine what needs to be included. If your Offer In Compromise seeks a periodic payment, you must make your first monthly payment with the application. If the Offer In Compromise is for the lump sum tax payoff, you must include a 20% down payment.

You may qualify for a low-income fee exclusion where the $205.00 fee is waived. To see if you qualify, please refer to the income chart in the instructions for Form 656.

If you submit an Offer In Compromise based on Doubt as to Liability, the only form submission will be Form 656-L. Under this request, no application fee or 433 forms are required.

What to Expect If the IRS Accepts Your Offer In Compromise?

It’s essential to recognize that the IRS may request additional information during the approval or denial process. It is imperative to respond to these requests promptly; otherwise, the IRS will reject your offer. Having a tax professional represent you is an ideal way of safeguarding that all IRS information requests are timely. If the IRS rejects your offer due to a lack of response, you will not get to appeal that decision.

When your Offer In Compromise (OIC) is approved, the IRS will notify you in writing of its decision. Approval means the IRS has agreed to allow you to pay off your taxes for less than you owe. If approved for the Lump-sum offer, you would have five months to make the payments. If this deadline is missed, your offer is no longer valid. If approved for the Periodic Payment Offer, the monthly payment period would be six to 24 months.

In either offer plan, you must stay compliant with tax filings and payment obligations; otherwise, the IRS reserves the right to terminate the agreement and demand payment for the tax balance owed.

In addition, if you are due a tax refund for the tax year the offer was accepted, the IRS may keep that refund. The IRS’s keeping this refund will not adjust the offer amount owed.

What to Expect If the IRS Rejects Your Offer In Compromise?

The IRS will notify you in writing if your offer has been rejected. Any payments made up until that point will be applied toward your tax balance and will not be refunded back to you.

While the IRS is determining an OIC, tax debt collection efforts are halted; however, they will resume immediately after rejection unless an adequately filed appeal has been made. An appeal request must be made within 30 days of receiving the offer’s rejection.

It’s essential to ensure that you have put together a well-constructed offer package and have other payment arrangement considerations available in case of rejection. Employing a tax attorney-CPA will ensure you have adequate coverage for either situation.

What Does an IRS Offer in Compromise Time Frame Look Like?

Narrowing down an exact time schedule is challenging because most situations have variations. However, the list below portrays what a typical time frame from start to completion could reasonably be.

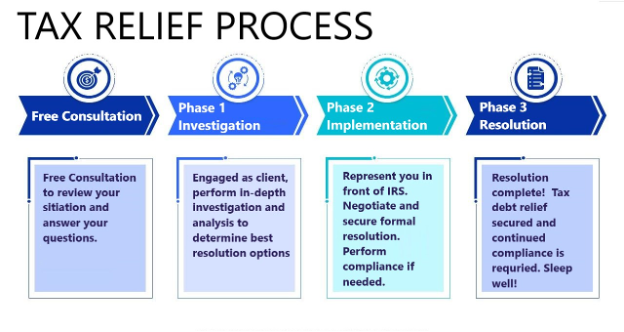

- First Day, contact a tax lawyer-CPA for an initial consultation. Based initial information presented, they will approximate the expected time frame for your situation.

- One to Three Weeks — Fact gathering time where tax attorney-CPA will retrieve tax records from IRS and personal or business financial data from you. OIC Plan is drawn up for reviewal and submission.

- Thirty Days After Rejection — Thirty days is the amount of time you must appeal if the IRS rejects your offer. During this time, the IRS will not reengage in collection efforts. If an appeal is not warranted, another resolution option must be pursued.

- Five Months After Acceptance — Amount of time allotted for the Lump Sum Payment option, where the entire amount must be remitted once the IRS approves this plan.

- Twenty-four Months After Acceptance — Amount of time allotted for the Periodic Payment option where the entire amount must be remitted via monthly payments once the IRS approves this plan

- Five Years After Acceptance — The terms of most OICs stipulate that you must stay compliant with tax payment and filing obligations for five years after you get an OIC. If not, the IRS may be able to revoke the agreement and demand payment in full.

There could be variations to this time frame depending on your situation. IRS could complete the review before six months or even take up to a year or more.

The Expense of Applying for an Offer in Compromise

There are various factors to consider when determining the expenses for applying for an OIC:

- The application fee for OIC is a standard fee to pay unless you’re applying for Doubt As To Liability or you qualify for a low-income fee waiver.

- If applying for a Lump Sum OIC Payment Offer, an initial 20% of your total offer will need to be included with the application. Once this offer is approved, the remaining portion of the offer will need to be paid off within five months.

- If applying for a Periodic Payment OIC Offer, you must pay the remainder of your offer in payments over two years. With this plan, there is the option to make a lump sum payment at any time during the twenty-four-month period.

- Professional fees are usually based on the amount of taxes owed.

What is the Advantage of Hiring a Tax Lawyer to Help Prepare your IRS Offer in Compromise?

A tax attorney CPA uses their skillsets and experience to help your OIC approval odds while ensuring the lowest offer possible is submitted. Since the overall approval average is around 30%, having a tax professional help you is advantageous. In addition, a solid tax lawyer will only suggest you apply for an offer in compromise after establishing whether you meet the strict guidelines required by the IRS. Often it takes a skilled tax lawyer to complete the required comprehensive financial analysis of your situation correctly to ensure you pursue the best tax resolution option available.

Get Help Applying for a Offer In Compromise with Trusted Representation at Your Side! Call 772-418-0949 for FREE CONSULTATION with Tax Attorney-CPA-EA, Will Harmon. Sleep well again at night!

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.