IRS Relief for First-Time Penalty Abatement & Reasonable Cause Penalty Abatement

Incurring IRS penalties can be very costly; it’s worse than just having an added tax placed against your tax balance because your tax balance can continue to grow substantially with penalties. Additional penalties and interest will pile up as time passes, making resolving it even more challenging. The IRS recognizes this and is willing to abate some penalties.

Very rarely does the IRS automatically decide to remove penalties like they recently had by removing late filing penalties for 2019 & 2020 tax filers due to Covid 19 impacts. Ordinarily, you must formally request some form of penalty abatement from the IRS. There are various circumstances in which the IRS will consider penalty removal, such as if the penalty was assessed based on incorrect advice provided by the IRS, if there is a reasonable cause for incurring the penalty, or if you are a first-time offender.

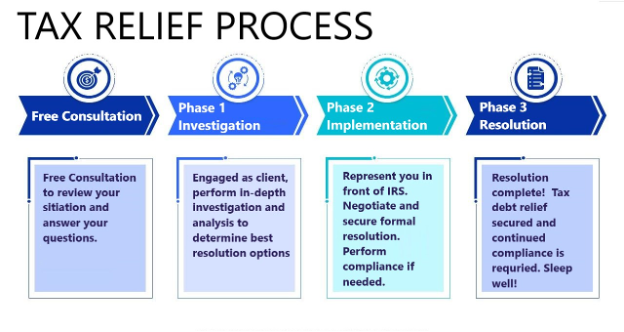

Since you must convince the IRS to abate the penalties, understanding the tax laws will help tremendously. A tax professional can significantly help you through the process. At Harmon Tax Resolution, LLC, tax attorney-CPA-IRS EA Will Harmon can help you apply for Reasonable Cause or other types of IRS penalty abatement relief. Contact him Today for a free consultation on how he could assist you with penalty abatement relief. Please read on for more information about penalty abatement relief.

What Is IRS Penalty Abatement?

IRS Penalty Abatement, or IRS Penalty Relief or IRS Penalty Waiver, occurs when the IRS approves a request to remove IRS tax penalties from your account. Most income tax penalties the IRS assesses are eligible for abatement consideration. The type of penalty and its respective cause of occurrence will determine which abatement procedure the IRS requires.

Which IRS Penalties Qualify for Abatement?

Over 150 IRS penalties exist for late filing, payment, return errors, and other non-compliant activity. However, you can request an abatement for the following:

- Failure to File Penalty occurs if you don’t file your tax return or file your tax return late. The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a late tax return. The penalty won’t exceed 25% of your unpaid taxes. Failure to File Penalty amount also accrues at the annual interest rate the IRS sets. To avoid this penalty altogether, it’s recommended to file your tax return promptly, even if you cannot pay the Tax due by the due date.

- Failure to Pay Penalty — This penalty comes into play when you file a tax return but don’t pay it. Typically, underpayment penalties are 5% of the underpaid amount and capped at 25%. Underpaid taxes also accrue interest at a rate the IRS sets annually.

- Failure to Deposit Penalty — If the business fails to make its deposits as scheduled, in the correct amount, or the manner required, the IRS will charge a federal tax deposit penalty. For amounts not properly or timely deposited, the penalty rates are: 2% — deposits made 1 to 5 days late, 5% — deposits made 6 to 15 days late, 10% — deposits made 16 days or more late, but on or before the 10th day after the date of the first notice we sent you asking for the Tax you owe.

You can seek relief regardless of the amount for these three types of penalties. However, for a trust fund recovery penalty, you may only seek relief through an appeal by establishing that you should not have incurred it. If you have penalties related to tax fraud or tax evasion, you will generally be unable to request abatement.

These IRS tax penalties are not assigned a fixed dollar amount. It is the total amount of the tax liability that determines this. The tax penalties are a percentage of the Tax you didn’t report, pay, or deposit. The amount of the penalty relief you may seek could vary significantly depending on the underlying tax obligation amount.

Abatement Request Are Not for All IRS Tax Penalty Types

Many other IRS penalties generally require different procedures to request relief. For example, if you were to receive the estimated tax penalty, ordinarily, you would have to request an exclusion from the penalty when filing your tax return (individuals use Form 2210) rather than just seeking an abatement.

Other penalties are proposed during IRS audits and investigations. These include fraud or accuracy penalties and typically require you to deal with IRS appeals officers or auditors before the penalty assessment. For return accuracy penalties, you can still request abatement after penalty assessment; however, doing so may require taking the IRS to court or using some particular IRS procedure. Seeking the assistance of an experienced tax attorney will ensure a proper relief approach is taken. For a free consultation with a multi-licensed tax attorney-CPA-IRS EA, please inquire.

How Interest on Tax Penalties Work

Regardless of the type of IRS debt, whether from a tax balance owed or IRS penalties applied, the amount is subject to having interest applied once it becomes due. The interest rate applied is in line with the Federal interest rate and is adjusted quarterly to match any changes. In addition, the interest calculation is compounding, meaning interest accrues on the interest accumulation. If not addressed, the balance can increase quickly.

Can IRS Interest Be Abated?

Assigned interest associated with tax debt is not abatable unless the tax assessment is done incorrectly. However, if you successfully get some form of penalty abatement, any interest associated with that penalty will also be abated.

What Is the IRS First-Time Penalty Abatement?

The IRS First-Time Penalty Abatement is an administrative waiver that the IRS may grant to relieve you from penalties for Failure-to-File, Failure-to-Pay, and Failure-to-Deposit if specific criteria are met. In addition, no explanation is needed for why you late paid your tax balance or filed your tax return late. Firstly, you must communicate to IRS that this is your first penalty. Secondly, you must demonstrate that you meet the compliance requirements, including reporting and payment obligations.

Reporting compliance, if required for the last three years, you must demonstrate that you filed the type of return in which the penalty was assessed.

Let’s say you are applying for relief from a penalty for late filing of a payroll tax return due in 2022. For penalty abatement purposes, you must have timely filed your payroll tax returns for 2021, 2020 & 2019. Now consider if you were applying for a late filing penalty on your personal 2022 income tax return, but 2020 was the first time you were required to file. You will not have to meet the three-year compliance requirement because you were not required to file for three years. You would still have to show that your 2020 tax return was timely filed, satisfying the compliance requirement.

Another element to show is that you have not incurred any penalties over the last three years before the year the penalty took place. However, you still meet this requirement if you incurred a penalty but had it removed for a different reason than First-Time Penalty Abatement. For example, if you used a statutory exception as a basis for removing a penalty, you may still be eligible to apply for the First Time Penalty Abatement.

Payment Obligations

You can apply for abatement relief if you still owe the Tax related to the requested penalty. But not if an outstanding tax due is unrelated to the abatement penalty request. For example, if you are applying for relief for penalties related to a 2020 tax return while you also have an outstanding balance for 2019, you can’t get penalty relief until you pay the 2019 bill or set up a payment plan.

Suppose you chose not to pay the Tax on which the penalty is being abated. In that case, it’s essential to recognize you will begin incurring an additional late payment penalty of 0.5% every month toward the balance due. Paying the Tax or setting up a payment plan may be your best option here. For example, you owe $20,000 in federal income tax when the penalty was abated, and you did not pay the Tax. At this balance, a late payment penalty assessment would be $100 monthly, adding up quickly. It may be advantageous, in some circumstances, to pay the tax debt or set up payment arrangements on the Tax before seeking penalty abatement.

How to Request the IRS First-Time Penalty Abatement (FTA) Relief

You can request FTA by calling the IRS at the number on your notice. Alternatively, you can fill out and submit Form 843 (Claim for Refund and Request for First-Time Abatement). To fill out this form, you need basic information about your incurred penalties and the tax return associated with the penalties. This includes the type of return, type of Tax, and the tax period.

There are several ways you can request an FTA:

- Fill out and submit Form 843 (Claim for Refund and Request for Abatement). If for FTA

- If for FTA – we only need to list accordingly

- If for Reasonable Cause, be sure to check the appropriate box in 5a and then, in section 7, provide a complete explanation of why you are seeking relief (more about Reasonable Cause below)

- Call IRS – use the number listed on the notice

What are the Requirements for IRS Penalty Abatement From Reasonable Cause?

To request Reasonable Cause (RC) consideration, you must have a legitimate reason for late filing the return or paying the Tax. Typically, RC occurs when situations arise outside one’s control, causing one to miss IRS filing or paying requirements. If negligence or recklessness occurred, causing the penalty situation, RC relief would not be available as a remedy. It would help if you established that you exercised ordinary business care and prudence and acted in good faith.

Late filing of tax returns, late payment of taxes due, or tax deposits are situations where you may be eligible for RC relief consideration, depending on surrounding facts and circumstances. In some circumstances, Accuracy-related penalties may also fall under RC relief consideration. Listed below are situations where RC relief may be available (not an all-inclusive list):

- Natural Disasters – such as hurricanes, floods, tornados, earthquakes, insect infestations, wildfires, etc. cause you to file your returns or pay your taxes late.

- Infirmity, Death, or Absence of taxpayer, immediate family, or caretaker significantly prevented the ability to file a tax return, pay taxes due, and make timely deposits.

- Lack of Access to Records Critical records needed for tax return completion are unavailable due to reasons outside your control.

- System issues that delayed a timely electronic filing or payment.

- Other Legitimate Reasons not listed above are out of your control, causing failure to file tax returns and pay taxes or deposits due timely

To properly request RC abatement relief within the application, you must adequately prepare a written explanation of your reasoning. Having a dedicated IRS tax attorney could help tremendously with this process. For a free consultation on how multi-licensed tax attorney-CPA-IRS EA Will Harmon of Harmon Tax Resolution, LLC can help, please call or complete the inquiry request.

Not all situations will qualify under Reasonable Cause for IRS abatement relief. Listed below are situations in which the IRS disqualifies for this relief:

- The inability to Pay Tax is not a reasonable cause. However, there are other tax relief options to consider when you cannot pay, such as applying for Currently Not Collectible status or possibly a form of Offer-In-Compromise or a Partial Pay Installment Plan.

- Misunderstanding Tax Law is not a valid reason for filing your tax returns or paying taxes late.

- Late Filing or Late Payment by Your Tax Professional is not considered a reasonable cause because you, as the taxpayer, are on the hook for filing tax returns and paying taxes on time.

- Mistakes – You are expected to catch errors on tax returns reasonably. However, if you reasonably attempt to comply with the tax law, there may be a plausible argument.

It may be helpful to reach out to a tax attorney to review your situation and let you know if your reasons for relief have merit or not. Ultimately, the IRS decides, but having a tax attorney will help steer you in the right direction.

How to Apply for Reasonable Cause IRS Penalty Abatement

You must complete IRS Form 843 – Claim for Refund and Request for Abatement. Accompanying facts and circumstances must support your request. It is imperative to present well-organized, clear documentary proof for the relevant facts presented and support for causal points being made. This is an area in which an IRS Tax Attorney-CPA may be able to help you.

The IRS looks at the following factors when determining if you have a valid case for a reasonable cause:

- When and what happened?

- The circumstances and facts inhibited you from filing your tax return and/or paying the due Tax.

- How did your situation impair your ability to file your tax return and pay the Tax due timely?

- What were the facts and circumstances surrounding the situation that inhibited you from timely filing your tax returns and/or making timely payments?

- How timely, and what was your remedy to the situation once you became aware?

- The IRS will also factor in who was responsible for executing the return or making a deposit or payment when dealing with tax returns involving potential other parties, such as corporate returns, trusts, or estates.

It is imperative to provide solid proof to support your position adequately. These are some of the documents to consider using:

- Medical Records – hospital – dental – rehab

- Physician letter detailing surrounding time frames (dates), types of illness, and ill effects.

- Court Records

- Law Enforcement Records

- Documentation of natural disasters, etc.

- Death Certificate

- Insurance claims to support damage.

If you request tax relief over the phone, you will be directed to fax or mail all of your pertinent documentation and written statements to the IRS; otherwise, plan to include these documents with your relief application.

How to Complete a First-Time Penalty Abatement or Reasonable Cause Letter

You can directly send a penalty relief request letter to the IRS. Be sure to include the following in your request letter:

- Your complete name as listed on the tax return/notice and tax ID number (SS, ITIN, EIN).

- The tax form (i.e..1040, 941, 1041) and tax period – this will be listed on the notice.

- The notice number and date if you’ve received a notice (top right-hand corner 1st page).

- The relief type (First-Time Abatement or Reasonable Cause).

It’s best to list this information in the upper part of the letter. Directly below this, indicate the relief request and a corresponding explanation of how the relief criteria have been met. Please list the applicable IRS tax code or statute for each compliance requirement to strengthen your case and make it more concise. Finally, sign and date the document.

Enlisting the help of a tax attorney-CPA will ensure the completeness and accuracy of your IRS abatement letter or form request. For a free consultation on how tax attorney-CPA-IRS EA Will Harmon could provide

What is a Statutory Exception Used for Penalty Abatement

A statutory exception stems from when you act upon advice rendered by the IRS, which turns out to be incorrect, causing you to incur penalties. Although not a frequent occurrence, they do occasionally happen. You must provide proof of the IRS’s erroneous advice and the consequences. Anything less will most likely result in a denial of your request.

For example, let’s suppose you are working with an IRS agent, and they sent you a letter, fax, or email indicating an incorrect due date for a tax filing, and you relied on this advice and filed accordingly. As a result of this reliance, you were penalized.

Remedying this situation is straightforward if you send a copy of the errant message within your abatement request.

How to Complete Penalty Relief Due to Statutory Exception Request

Form 843 is generally used for filing requests, or you can call the phone number on the notice. For Statutory Exception Abatement Requests, be sure to complete the following steps:

- Submit a copy of the written advice request made to the IRS.

- Submit evidence of the IRS’s erroneous advice.

- List any tax adjustments that tie to the penalty and/or show any additional taxes incurred and any other evidence supporting your position.

Partner with a Tax Attorney-CPA-IRS EA Who Can Assist With Tax Penalty Abatement

If you believe you qualify for penalty abatement or need assistance with another tax matter, contact the tax attorney, CPA, IRS EA Will Harmon by calling 772-418-0949 or completing an online inquiry request. Call Today and sleep well Tonight.

Get Help Applying for Penalty Relief with Trusted Representation at Your Side! Call 772-418-0949 for FREE CONSULTATION with Tax Attorney-CPA-EA, Will Harmon. Sleep well again at night!

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.