IRS Relief From Joint Liability Tax Attorney CPA in Port Saint Lucie, Florida

What Is Relief From Joint Liability? Do I Qualify for Relief from Joint Liability?

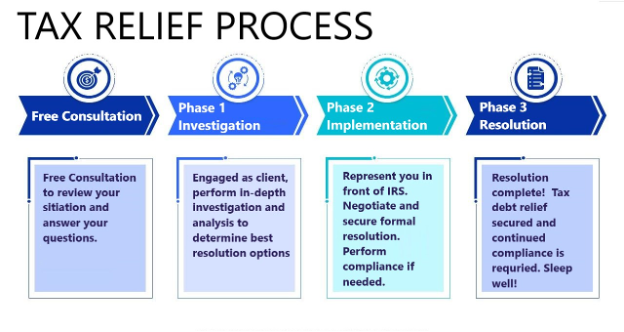

In the case of a joint return, both taxpayers are liable for the tax and any interest or penalties, even if they later separate or divorce. “Joint and several liability” means that each taxpayer is legally responsible for the entire liability. In some cases, however, a spouse who filed joint returns can receive relief from joint and several liability. Call today for a free consultation to see if you qualify for this type of relief.

The Four Types of Joint Liability Tax Relief:

- Innocent Spouse Relief: Provides relief from additional tax if a spouse or former spouse failed to report income or claimed improper deductions unknown to the innocent spouse.

- Separation of Liability Relief: Provides for allocating additional tax owed between the taxpayer and their legally separated spouse, former spouse, or widow because of an incorrectly reported item on a joint return. The tax allocated to the taxpayer is the amount they are responsible for, and the relief-seeking taxpayer was unaware of it.

- Equitable Relief: This may apply when a taxpayer does not qualify for innocent spouse relief or separation of liability relief for items not reported properly on a joint return and generally attributable to the taxpayer’s spouse. The IRS decides based on facts and circumstances to determine whether it would be unfair to hold the taxpayer liable for the understated tax.

- Injured Spouse Relief: This May apply when a taxpayer’s refund being offset is due to prior activities/debts incurred by the other spouse for which the taxpayer had no responsibility.

Let us help you see if you qualify for any type of joint spouse relief so that you will not be unfairly burdened with another’s tax liability. There is a time limit when one can apply for some of these types of relief. For help, contact us right away so that our Attorney-CPA-EA will ensure that elements of your situation have been properly addressed to see if you qualify for the relief you deserve.

Let us help you find a solution to your tax problem. Call us today at (772) 418-0949 or complete our online form to request a free consultation with a Relief From Joint Liability Lawyer.