Unfiled Tax Returns and the IRS Statute of Limitations

Life activities can cause filing your tax returns to become a lesser priority resulting in non-filings to occur. If you are in this situation, please note that if you meet filing requirements, you must still file your tax returns.

The filing requirements are based on your age, filing status type, and respective amounts of income. The IRS provides an active interview format on its website to help you determine if you need to file.

What Happens to My Tax Refund If I Do Not File Tax Returns?

To get a refund, you must file your tax returns. In addition, you must file the tax return within three years of the filing deadline to get the refund.

For example, if you have six years of unfiled taxes returns due, you may get refunds on the most recent three years and not for any of the others from years four through six. In contrast, if you only had the most recent two years on unfiled returns, you would be eligible for both years’ refunds.

Unfortunately, if you owe back taxes, the IRS is not limited to going back three years.

Non-Tax Return Filing Consequences

The only consequence you will suffer if you fail to file returns where refunds were due is to miss out on the refunds. Not to suggest taking this lightly since it could cause a significant loss. In contrast, if you owe a tax liability and do not file, you could now be subjected to IRS collection procedures, leading to severe consequences. This generally happens when you owe taxes and have not filed a tax return.

Income Tax Penalties and Interest – Late Filed Returns

Late Filing Penalty

The IRS typically charges penalties and interest when returns are filed late. The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The Penalty won’t exceed 25% of your unpaid taxes. For instance, if you owe $2,000, the failure to file Penalty is $100 monthly, which can get up to $500. The Failure to File Penalty applies the first day you are late, along with interest starting to accrue. Even if you cannot pay the taxes owed, filing your tax return is usually the best option since late paying penalties accrue at a much lesser rate.

Late Payment Penalty

The Failure to Pay Penalty is 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid, which accrues at 1/10th the rate of the late filing penalty. The Penalty has the same cap of 25% as the late filing penalty; however, it will take significantly longer to accrue to this amount. Like in the last example of a $2,000 tax debt, that’s $10 per month versus $100. In addition, If you filed your tax return on time as an individual and you have an approved payment plan, the Failure to Pay Penalty is reduced to 0.25% per month (or partial month) during your approved payment plan.

Interest

The IRS charges underpayment interest when you don’t pay your tax, penalties, additions to tax, or interest by the due date. IRS will continue to charge interest until you pay off the balance.

Substitute for Return (SFR)

When you file a tax return, the IRS often has third-party reported information to cross reference your return. Because of this, even though you don’t submit a tax return, the IRS may use what data it has to prepare a return for you. IRS relies on IRC § 6020(b) to file tax returns for delinquent taxpayers as part of the SFR program. Third-party information consists of:

- Employer W2s or 1099s

- Banking interest income

- Financial Brokerage Firm – Trading information – dividends, capital gains

- Equity Ownership K-1s

- Unemployment WG2

- Gambling Winnings W2c

If what is reflected shows you have tax filing requirements, the IRS may prepare a tax return on your behalf, which usually overstates the taxes you may owe. The IRS will not consider any credits or allowable expense deductions you may be entitled to, resulting in your owning significantly more in taxes or not receiving the refund you may be entitled to have if you had completed your tax return.

The SFR processing begins with the IRS sending out an information letter stating that they have not received tax returns for a particular year(s). The IRS will then propose a tax liability consisting of the SFR return’s tax assessment, associated penalties, and interest. The information will indicate that you have thirty days to respond by doing one of the following:

- Complete and send the applicable 1040 tax return and any other required forms.

- Sign off on the consent form in agreement with the terms.

- Provide a response indicating why you meet non-filing requirements or any other unique circumstances the IRS should consider on your case.

You have thirty days from the date in the Information Letter to respond. If you fail to respond within that timeline, the IRS will send a Statutory Notice of Deficiency, a 90-Day Letter. The purpose of this letter is to inform you that the IRS will assess the tax amount along with associated interest and penalties at the end of the 90 days from the notice’s date. You are also informed of your right to petition the US Tax Court during the 90 days. If there is no response during the 90 days, the IRS can now assess the tax amounts and engage its full-scale collection efforts for these due taxes. IRS collection efforts may include attaching liens and rights to your property. Eventually, the IRS may escalate collection efforts by placing levies on your bank accounts or garnishing your wages. The IRS could even seek to foreclose on your home. Calling a tax attorney may help alleviate the IRS collection efforts before they get out of hand.

Taxpayer Identity Theft Exposure from Not Filing Tax Returns

Unfortunately, more and more taxpayers are being exposed to identity theft. With this scam, someone uses your social security number, files a fake return, and has the refund sent to their bank account. Not filing your taxes increases your risk of this happening because you will quickly become aware that something has occurred when you file. The IRS will immediately reject a tax return if someone else has already filed under your social security number or has used one of your dependent’s social security numbers on their return, which you have attempted to use on your return.

Also, the IRS sends correspondence to the last known address on file, which usually comes from your most recently filed tax return. If you have moved and have not filed since, the IRS may be trying to reach you and cannot. It is up to you to notify the IRS of any address changes. Filing your taxes as soon as possible help minimize the risk of someone else being able to file on your behalf falsely.

When Should I File Back Taxes?

The IRS has specific rules on who must file taxes every year. As of 2022, you must file a tax return if you meet any of the following criteria:

- Your income is over $27,700, and you’re filing as married filing jointly or as a qualifying widower.

- Your income is over $20,800, and you’re filing as head of household.

- Your income is over $13,850, and you’re filing as single. If over the age of 65, the income threshold is $15,350.

- Your income is over $5, and you’re filing as married filing separately.

- You had self-employment net earnings of at least $400.

- You made more than $108.28 from a church or church organization.

- You owe the alternative minimum tax.

- You owe an early withdrawal penalty from an IRA or 401(k).

- You owe household employment taxes.

- You owe Social Security or Medicare tax on tips you didn’t report to your employer or that your employer didn’t already take out of your pay.

- You received distributions from a health savings account, Archer Medical Savings Account, or Medicare Advantage MSA.

- You owe taxes on an IRA, health savings account, or other tax-favored account.

- You owe recapture taxes.

- Advance payments of the premium tax credit were made for you, your spouse, or a dependent who got health coverage through the insurance marketplace.

- You owe uncollected Social Security, Medicare, or railroad retirement tax on tips you reported to your employer or group-term life insurance and additional taxes on health savings accounts.

The rules are different if you are being claimed to be dependent on someone else’s return.

In addition, the income filing thresholds change every year. You must look at the filing requirement for the year you are filing for.

Even If I Am Not Required to File, Should I Still File?

Before you decide not to, you will want to consider whether, by filing a return, you could be getting money back from:

- You had federal income withheld from your pay.

- You made estimated tax payments.

- You may qualify to claim tax credits like

- Earned Income Tax Credit

- Child Tax Credit

- American Opportunity Tax Credit

- Premium Tax Credit

- Health Coverage Tax Credit

- Credits for Sick and Family Leave

- Child and Dependent Care Credits

- Credits for Federal Tax on Fuels

Do All Missing Tax Returns Have to Be Filed?

Suppose you have some years of unfiled returns and want to get your account caught up with the IRS. It may be that you do not need to file for some of the years in which you missed a return. For example, let’s say your filing status is single, and you have not had any tax returns over the last six years.

In 2017, your income was $30,000. In 2018, your income was $3,000. In 2019, your income was $32,000. In 2020, your income was $6,500. In 2021, your income was $27000. In 2022 your income was 8,500. You did not have any special taxes that could trigger a reporting requirement, and you did not have any self-employment income.

For 2017, 2019 & 2021, your income exceeded the filing threshold; therefore, returns for each year must be filed. However, in 2018, 2020, and 2022, your income was under the threshold resulting in not having to file returns for those years. However, before not filing for those years, you want to ensure you are not missing out on some benefit from doing so.

Even If I Am Not Required to File, Should I Still File?

Before you decide not to, you will want to consider whether, by filing a return, you could be getting money back from:

- You had federal income withheld from your pay.

- You made estimated tax payments.

- You may qualify to claim tax credits like:

- Earned Income Tax Credit

- Child Tax Credit

- American Opportunity Tax Credit

- Premium Tax Credit

- Health Coverage Tax Credit

- Credits for Sick and Family Leave

- Child and Dependent Care Credits

- Credits for Federal Tax on Fuels

It may be prudent to at least go through the mechanics of preparing a return to see if you are eligible for any of these credits.

Does the IRS Have a Statute of Limitations on Unfiled Tax Returns?

The IRS has no statute of limitations on an unfiled return. The IRS is not limited to when they can go back and prepare Substitute for Returns. Even if you had not filed in the last 25 years, the IRS could go back and make tax assessments on any years in which taxes could be due. However, several separate statutes involving assessment, refunds, and collections can be confusing. To help better understand these types of statutes, here is a breakdown of them.

IRS Assessment Statute Limitation

Assessment Statutes of limitations generally limit the time the IRS must make tax assessments within three years after a return is due or filed, whichever is later. That date is also called the Assessment Statute Expiration Date (ASED).

However, the ASED can be extended under the following circumstances:

- Failing to file your tax return. IRS can assess tax under the Substitute for Return (SFR) program. If you voluntarily fail to file your tax and the IRS has enough information to file one for you, it may elect to proceed with the filing. The standard three-year ASED does not adhere to SFRs allowing the IRS to assess tax and additional tax at any time. Subsequently, if you elect to file your tax return, the normal ASED three-year time limitation is now in place.

- Sign a statutory waiver to extend ASED. You can agree to allow the IRS to extend the assessment time by signing a statutory waiver or extension agreement. If the IRS proposes a waiver to extend the ASED, you can negotiate the proposed time limitation to assess or refuse to sign the waiver. It may be prudent to speak to a tax professional before doing so.

- Tax Omissions of more than 25% of your gross income from a tax return. If you have such an omission, the IRS can assess additional tax increases from three to six years from the date your tax return was filed.

- If you file a false or fraudulent return intending to evade tax, the IRS has unlimited time to assess tax.

The IRS cannot assess tax after the time limitation period for assessment has expired.

IRS Tax Collection Statute Expiration Date – Statute of Limitations

The Collection Statute Expiration Date (CSED) provides that the IRS has ten years from the tax assessment date to collect to collect or else it becomes unenforceable. Some occurrences can toll the statute, such as applying for specific tax resolution plans or appealing assessments. The CSED plays a vital role how determining how to deal with the IRS. Often it can be beneficial to inquire with a tax attorney on how the CSED impacts any potential IRS negotiations.

IRS Tax Refunds Statute of Limitations

The refund statute of limitations for claiming a refund is three years after the filing deadline.

The IRS Regulations Sec. 6511(a) and Regs. Sec. 301.6511(a)-1(a) provides that you are eligible to claim a refund or credit if requested within three years from the date of filing the tax return or two years from the date the tax was paid, whichever is later. Please note that a tax return paid or filed paid before the last day allotted for its filing or payment (not regarding extensions filed) is considered paid or filed on that last day.

For example, let’s say that you file a tax return on April 15, 2020, and you owe taxes. You pay the tax bill on August 23, 2020. Eventually, you realize you made a mistake and plan to amend your tax return to claim a refund. Three years from the filing date is April 15, 2023, and two years from the payment date is August 23, 2020. You can claim a refund up to the latter date.

When you did not file a return, and there were tax payments made, you must file for a credit or refund of an overpayment within two years from when the tax was paid. Typically, this could occur for w2 income tax withholdings from employers or self-employed individuals who made larger than the required estimated payments. In the absence of a tax return being filed, one would take two years from the time the taxes were paid to file a claim for a refund.

How Do I Handle My Unfiled Tax Returns?

Getting professional tax help with your unfiled returns may be the best way to properly get through them as soon as possible in the most efficient manner. Tax professionals already have the right tax programs, understand the appropriate filing rules, and can help you avert unpleasant IRS repercussions.

On the other hand, if you choose to file your back taxes on your own, here are some procedures you may want to consider:

- Reach out to the IRS to determine your status with them to see if an SFR has been filed and if your case has been assigned to IRS personnel.

- Go online and set up an account with IRS to pull your wage and income reports and confirm any taxes paid. An IRS representative can also retrieve this for you. In addition, seeing what the IRS has listed may help get year-end information from sources and confirm.

- Pull all applicable year-end tax documents such as investment information, W2s, 1099s, and bank statements.

- Research each year in question to ensure you obtain available credits and allowable deductions you may be entitled to.

- Because the tax code changes frequently, use the appropriate year’s tax form to ensure correct deductions and credits are applied.

How Many Years of Back Taxes Do I Need to File?

The IRS generally follows its policy 5-133, which provides a general rule that taxpayers must file six years of back tax returns to be in good standing with the IRS. Even so, the IRS can go back more than six years in certain instances. For example, you must complete all four years’ worth if you have four years of unfiled tax returns. If you have nine years of unfiled tax returns, you must complete the most recent six years of returns.

There is no statute of limitations on unfiled returns, so the IRS can differ from the six-year rule if large tax amounts are owed beyond this time frame or if they believe you may have committed tax fraud.

This is why working with someone with experience dealing with unfiled returns is essential. To protect yourself, ensure you or your tax preparer understands IRS policy 5-133 dealing with delinquent returns. This rule maintains that, in general, a taxpayer must only file six years of back tax returns to be in good standing with the IRS.

How to Address Past Due Taxes from Filed Returns

Getting your past tax returns filed may leave you with a large tax debt you cannot afford to pay. Depending upon your circumstances, there are a variety of IRS tax resolution options you may qualify for, such as:

- The installment plan allows you to make monthly payments on your tax debt until wholly paid off before the Collection Statute runs out.

- A Partial Payment Installment Agreement (PPIA) is a monthly payment plan option for those who cannot pay the total balance due by the end of the Collection Statute. Financial determination is completed for eligibility. A PPIA can prevent the IRS from taking further collection action, such as levies and seizures. PPIA does not prevent IRS from initiating liens.

- Offer in Compromise allows you to settle your tax debt for less than the total amount you owe. It may be a legitimate option if you can’t pay your entire tax liability or if doing so creates a financial hardship.

- Penalty Abatement. There may be some penalties eligible for abatement.

- Currently Not Collectible status: If you can establish that you can’t pay your taxes and basic living expenses, the IRS may place your account in Currently Not Collectible (CNC) status. Under CNC, you will not have to make tax payments; however, interest and penalties could continue to accrue. You will remain in this status until your situation improves or you have reached the CSED and your tax liability is cleared.

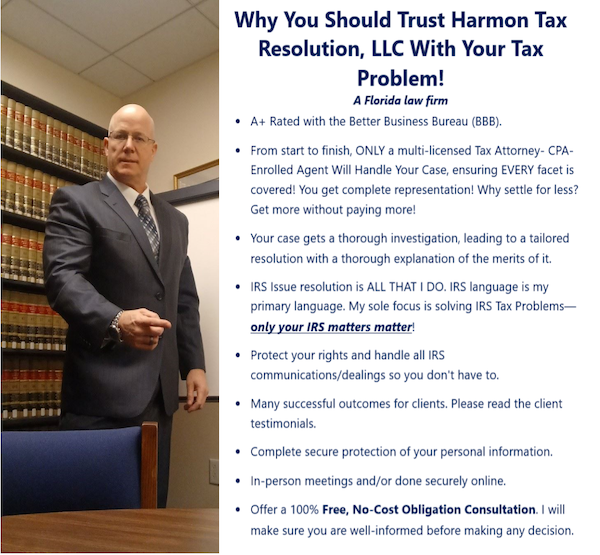

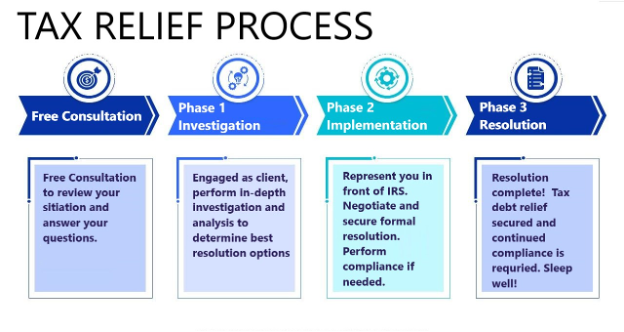

When you hire a multi-licensed tax attorney CPA EA, you are getting expert tax return preparation capabilities sets and equipping yourself with the best possible means of optimally dealing with any surrounding tax issues. Dealing independently with the IRS can often be a very stressful experience resulting in an unfavorable outcome. A tax attorney CPA alleviates this burden from you. They understand how to navigate the complexities of the IRS tax code, deal directly with the IRS, and can determine the best resolution options for your case. They can get the best results for you. This is where Harmon Tax Resolution, LLC – the tax law firm dedicated to helping you with your IRS issues.

Get Trusted Professional Tax Help with Unfiled Tax Returns and IRS Tax Debt Resolution

To ensure that you align yourself with the best possible tax resolution outcome, have an experienced tax professional provide expert guidance to get you there. Call today (772-418-0949), or complete an online inquiry form for a free consultation with experienced IRS Resolution Tax Attorney-CPA-EA, Will Harmon of Harmon Tax Resolution, LLC. He will handle your IRS tax issue so you can put this behind you and do what matters most.

For additional information, please see the following blog articles:

- “The IRS May Prepare A Substitute for Return in Place of an Unfiled Tax Return“

- “How to Deal with Back Taxes and What to Do About Unfiled Tax Returns“

- “Optimal Tax Return Preparation Services“

Tax Attorney-CPA-IRS EA Will Harmon of Harmon Tax Resolution is here, so you don’t have to face the IRS alone. He will help you fix, submit, and correct your unfiled returns. You will be assured of getting the absolute best resolution for your situation. To learn more, contact us today for your free consultation.

Harmon Tax Resolution will help you regain control so that you get back to being you! Contact us Today; sleep well Tonight.