- Free Consultation: (772) 418-0949 Tap Here to Call Us

Tax Attorney vs. CPA vs. IRS EA: Why Not Hire a Three-In-One?

Tax Attorney vs. CPA vs. IRS EA: Why Not Hire a Three-In-One?

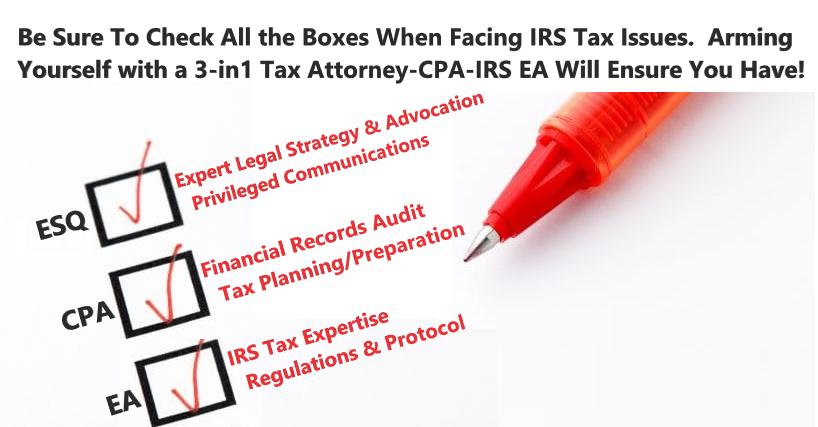

When looking for a tax professional to resolve a stressful and complex tax issue, whether personal or business-related, it can be challenging to narrow down which type of tax professional fits well for your situation. Wouldn’t it be ideal to employ a tax professional who can “check all the boxes,” enabling the most efficient and effective way to address your pressing tax situation?

Many tax and financial advising specializations are reflected by the many different professional designations across these professional spectrums, so much so that it has become exceedingly difficult to ascertain which type will provide adequate coverage for your tax situation.

The IRS has simplified this search by narrowing the field down to three types of tax professionals who are granted unlimited rights to represent clients before them: Attorneys, Certified Public Accountants (“CPAs”), and IRS Enrolled Agents (“EAs”). The IRS assumes that these are the most qualified and able professionals to represent taxpayers. Tax attorneys, CPAs, and EAs have different skill sets that may lend to choosing one over another based on purported needs for tax resolution. The range of skill sets among professional tax types can create a dilemma when choosing between them.

Since most people are not tax experts, it can be challenging to ascertain the best skillsets for their tax problems upfront. Most reputable tax resolution firms investigate your situation before determining the correct course of action. Frequently, many tax issues are complex and successful resolution requires a multi-facet approach. Therefore, hiring a multi-certified Tax Attorney-CPA-IRS EA will enable you to “check all the boxes,” their combined skillsets will cover all elements of your tax issue. This unique skillset combination enables them to see the tax problem simultaneously through three separate lenses, allowing for every angle of the tax case to be examined, coupled with the ability to address them correctly and appropriately. For example, if it becomes apparent that a legal issue is present, you already have an attorney. This synergy approach allows for savings in time and costs.

Let’s discuss the attributes of each of these tax professionals.

The Attributes of a Tax Attorney

Tax attorneys are lawyers who have completed law school to obtain a Juris Doctorate (“JD”), passed their state’s strenuous bar exam, and focused on tax issues in their practice. Many tax lawyers have obtained an LLM in Taxation or a certificate in taxation in their JD.

Unlike CPAs, who are remarkably adept at overseeing financial records and preparing tax returns, tax attorneys are geared more toward planning and dispute resolution. Tax Attorneys primarily focus on helping individuals or businesses minimize their tax liability by structuring assets or representing them through tax-related litigation.

While CPAs and EAs are allowed to represent clients in front of the IRS, they typically do not have the experience or training that a tax attorney would have when representing a taxpayer. If you are dealing with an audit that has the potential for severe penalties or facing a potential criminal issue, a tax attorney would be the ideal choice. Tax attorneys have strong advocation skills and explicit intimate knowledge of tax law and the tax code, including court cases and legislative tax history. Tax attorneys are ideal for negotiating problematic tax situations and fact patterns to reduce your taxes.

Tax attorneys also offer one significant benefit that CPAs and EAs do not — complete privileged communications. Any information you provide your tax attorney is protected by client-attorney privilege, meaning they cannot be forced to testify against you. Having attorney-privileged communication offers a distinct advantage if you are dealing with possible criminal charges from the IRS and wish to prevent conversations with your tax expert from inadvertently being used against you. In addition, for the tax practitioner to properly diagnose and employ appropriate resolution measures, they must have access to all case facts. If the taxpayer is unwilling to provide specific facts for fear of recrimination if their tax practitioner were called upon to testify against them, the case may not be resolved in the best way possible. Having an attorney in this type of situation is critical.

The Attributes of a Certified Public Accountant (CPA)

A CPA’s skillsets cover a broad range of accounting and finance fields due to the educational requirements of a 5-year degree, along with passing a rigorous CPA exam. CPAs are one of the most adaptable and resourceful financial professionals available because their ranges can typically cover auditing, taxation, and financial analysis, to record-keeping and business strategy. A CPA’s demanding education requirements and varied skillset set them apart from other accounting and finance professionals.

CPAs have earned a distinction for being the most sought-after advisors in their field. CPAs are the preferred choice for year-round financial reporting and tax preparation due to their well-rounded skillsets. While a CPA is one of your best options when filling out those complicated IRS tax forms, they can also serve as a primary advisor for various financial decisions, including investment, real estate advice, estate planning, specific IRS problems, and more.

In addition, only CPAs can render qualified opinions for financial audits; therefore, CPAs are the go-to for any audit-related concerns. If you are faced with a tax audit or need someone to audit your financial information for correctness, involving someone with a CPA background is an ideal choice vs. any of the other types of tax professionals. Attorney’s and EA’s designations are absent any audit proficiency requirements, whereas, for CPAs, audit proficiency is a vital component of the CPA exam. Hence, a key advantage of using a CPA is their ability to review or audit a business’s financial records to identify problem areas that need correction and where you are in good standing. Having well-maintained records allows for better decision-making and helps ensure compliance with IRS regulations.

Tax attorneys and EAs usually do not focus on balancing the books, finding errors in recording financial transactions, or helping you make a financial decision. Having a CPA is advantageous when faced with an IRS issue that may require these skill sets. However, one may be surprised to learn that many CPAs do not even handle tax matters. Many CPAs only handle books and accounting. They focus on preparing and auditing financial statements. It is essential to assess a CPA’s background in tax if needed for tax-related concerns.

The Attributes of an IRS Enrolled Agent (EA)

When choosing a CPA or an attorney for IRS tax issues, one must ascertain whether either has sufficient tax knowledge to properly navigate the IRS rules and regulations. That is not the case with an IRS Enrolled Agent. EAs are hyper-focused on IRS tax rules and regulations. All EAs have an in-depth knowledge of taxation and understand the ins and outs of dealing with the IRS at all administrative levels. The IRS considers the Enrolled Agent the “Gold Standard” for tax professionals based on tax knowledge and proficiency. Unlike CPAs and attorneys, the Enrolled Agent license is granted by the federal government through the US Department of Treasury. It is the highest title awarded by the Internal Revenue Service to tax experts, granting them an unlimited privilege to represent taxpayers before the IRS. To become an EA, one must pass a three-part Special Enrollment Examination that covers every aspect of individual taxes, business tax law, and professional ethics. Alternatively, an individual can be granted an EA license if they’ve formerly worked with the IRS for more than five years and will obtain clarification that their experience with IRS is adequate.

When considering an attorney or CPA to handle a tax problem, it would be prudent to ascertain whether either has comparable tax knowledge to an EA. Conversely, when looking to employ an EA, one must determine how to assess and address whether skillsets inherent in an attorney or CPA may be required to resolve a case correctly. There is a saying that one is only as strong as their weakest link. This also holds in tax resolution since the case may not be resolved correctly if any resolution criteria box is not checked off. With so much on the line, it is critical to ensure all bases are covered.

The Benefits of a Multi-Licensed-Certified Professional

Having a Three-In-One Tax professional enables you to “check all the boxes” needed to resolve a stressful and complex tax issue. It’s essential to recognize that, at the outset of a tax case, it is often unknown what all the required elements will be because most tax issues require a complete investigation to properly ascertain all angles of the case. Wouldn’t it be comforting to know that your chosen tax professional already “checks all the boxes” at the outset of the engagement? Just knowing this will provide a sense of relief.

Typically, a tax attorney is retained for more complex and specific tax issues. In contrast, the CPA is usually utilized to keep financial records in order, conduct and/or assist in audits, and prepare tax returns. EAs are primarily used for various tax issues and tax preparation. The advantages of having a three-in-one professional are hard to overstate since tax issue resolution of many IRS tax issues often involves a holistic approach requiring a combination of skillsets customarily associated with each of the three tax professional types.

For example, an IRS tax problem may contain tax issues requiring various elements such as proper case law research, litigation, stringent client advocation, and privileged attorney communications, which primarily check the “attorney” box. The same case may contain IRS compliance issues, such as amending tax returns or preparing unfiled returns to be completed, which falls under an EA’s realm. The CPA skillsets will be ideal if this case includes an audit component, which they often do.

Another example will be if the IRS requests an audit. Naturally, having a CPA would be ideal. As the audit progresses, there appear to be legal issues that ideally should be handled by an attorney. The audit also uncovered compliance issues that an EA would be ideal for addressing. Using multiple parties could make things somewhat disjointed and cost significantly more.

Employing a three-in-one tax attorney-CPA-EA will enable you to check all the boxes for your tax resolution issue. Harmon Tax Resolution, LLC offers such an all-under-one-roof solution. Will Harmon is an experienced tax attorney-CPA-IRS EA- MBA who can provide the complete representation your matter deserves. Contact us for a free consultation to see how he can offer a complete solution to your tax issue so that you can sleep well tonight.